Our Philosophy

We Manage the Mess so you can Manage Success.

If you’re not leveraging the latest tools for chargeback management, then you’re leaving money on the table. Our industry-leading chargeback management solutions thwart first-party fraud, stop chargebacks in their tracks, and recover revenue from unwarranted disputes.

Our Philosophy

We Manage the Mess so you can Manage Success.

If you’re not leveraging the latest tools for chargeback management, then you’re leaving money on the table. Our industry-leading chargeback management solutions thwart first-party fraud, stop chargebacks in their tracks, and recover revenue from unwarranted disputes.

Services

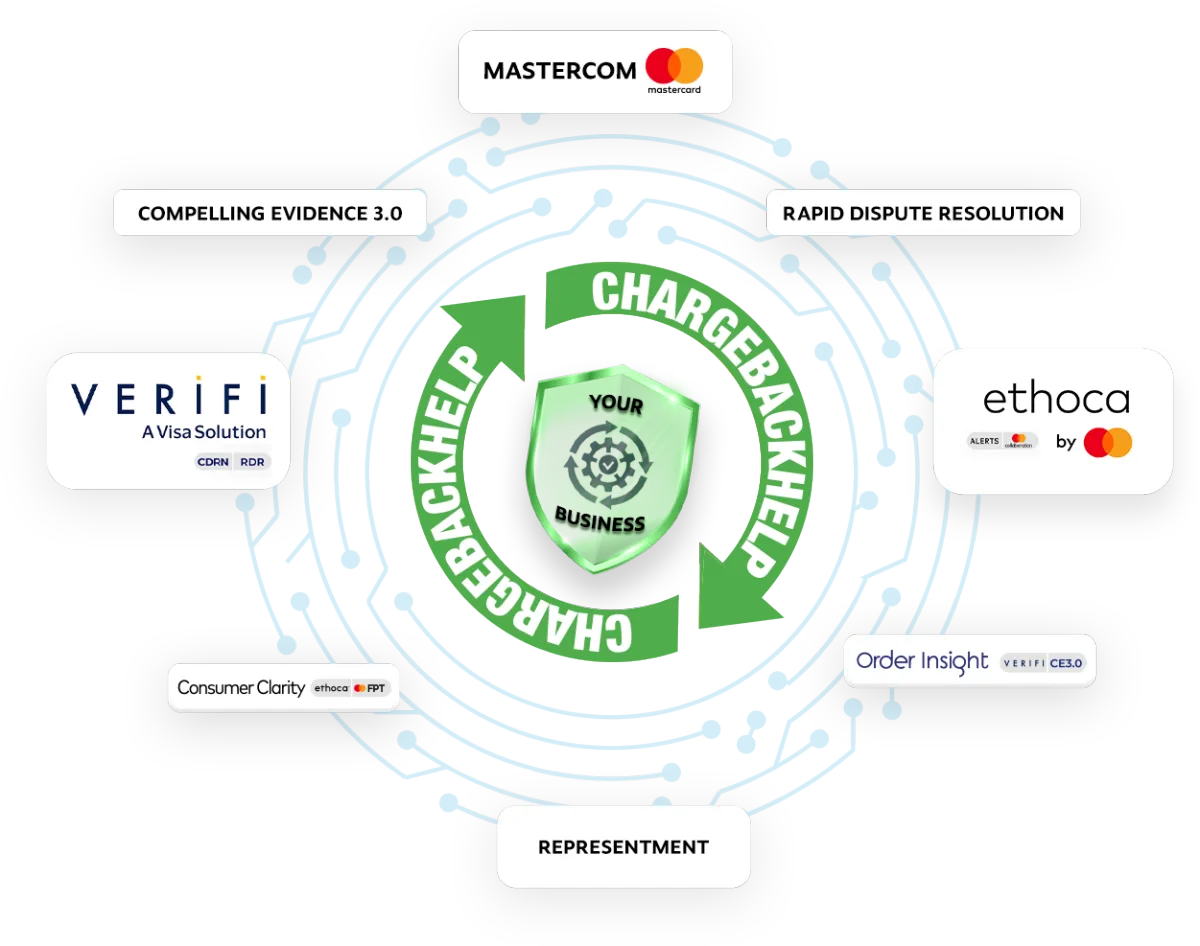

Complete Suite of Solutions

Pre-Dispute

DEFLECT

Dispute & Fraud Deflection

Pre-Chargeback

RESOLVE

Chargeback Prevention

Post-Chargeback

RECOVER

Automated Representment

About Us

Global Leaders in Chargeback Management & Prevention

At ChargebackHelp, chargebacks aren’t just part of what we do — they’re everything we do. For over a decade, we’ve led the charge in building complete chargeback management solutions trusted by thousands of merchants across every major industry.

Merchants know how overwhelming it can be to juggle multiple vendors with endless redundant tools. That’s why we built a single platform that brings it all together, seamlessly. ChargebackHelp makes chargeback management faster, simpler, and more effective.

Why Us

Partnering with ChargebackHelp Pays

Prevent Chargebacks

Stop chargebacks before they happen with deflection and alert technologies. Reduce risk exposure.

Processing Protection

Safeguard your merchant account compliance. Improve transaction acceptance with fewer declines.

Greater Operational Efficiency

Run leaner operationally with no more manual work. Automate your dispute workflows.

Reduce Cost

Eliminate penalties and fees tied to chargebacks. Boost profit margins and productivity.

Increased Customer Satisfaction

Strengthen trust & loyalty with fast responsiveness, clear communications, and resolutions.

Stay Compliant

Futureproof against changing card network regulations. We evolve so you’re always ahead.

Mitigate Fraud Losses

Disrupt first-party fraud with detailed transaction data. Recover revenue from fraudulent disputes.

Improve Chargeback Win Rates

Improve the representment workflow for optimum win rates. Automate compelling evidence.

Streamline Tools to 1 Platform

Consolidate chargeback tools from different card brands and providers into one integrated platform.

Our Portal

All-in-One Chargeback Management Solutions

We manage the heavy lifting, from technical integrations to ongoing maintenance and compliance, so you can focus on running your business. With direct connections to card networks, expert guidance and automated workflows, you get everything needed to prevent chargebacks and recover lost revenue in one unified solution.

Navigating the VAMP Landscape: What Merchants Need to Know

As of October 1, 2025 Visa has begun enforcing the Visa Acquirer Monitoring Program (VAMP) – with stricter thresholds coming in 2026. Understanding VAMP is essential, in order to master it. We offer a free VAMP Toolkit for everything you need to know about the program.

Watch this Fraud Boxer Podcast video for a breakdown of navigating the VAMP landscape, featuring our CRO, Bart Szypkowski.

Seamless

What Makes Us Different

CBH Calculator

How much do chargebacks cost your business?

Find out here with our Chargeback Cost Calculator

Testimonials

Our Clients

FAQ

Frequently Asked Questions

But Don’t Just Take Our Word

See how leading risk teams are consolidating chargeback workflows and improving performance with less manual effort.

See Solutions in action

Want to know how it works? Schedule a quick walkthrough and see how ChargebackHelp fits into your existing stack.